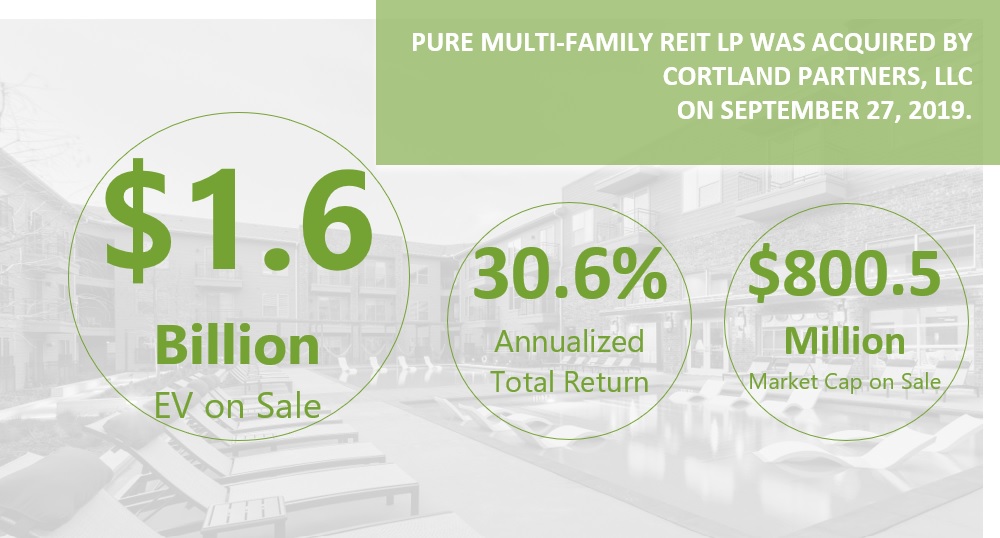

The Pure Group launched Pure Multi-Family REIT LP with a small IPO in 2007 and through a focused growth strategy established a beachhead portfolio of high-quality assets located in strong growth markets of the U.S. Sunbelt. In 2019, the Pure Group successfully divested the platform to the Cortland Group of Atlanta for $1.6 billion.

TOTAL RETURN PERFORMANCE

EXCEPTIONAL RETURNS – FROM IPO to $1.6 BILLION PLATFORM SALE

From IPO in 2012 until the sale in 2019, Pure Multi-Family REIT LP delivered

Total Annual Returns of 30.6%(1)

Source: Bloomberg. (1) IPO date of July 10, 2012. Delisting date of September 30, 2019. Prior to the launch of the C$ ticker on July 2, 2014, the C$ values were calculated based on the US$ ticker converted at the daily spot exchange rate. Distributions reinvested. RBC Capital Markets, Equity Research, Neil Downey, June 27, 2019.

Steve Evans, Founder & CEO together with the PURE executive team rings the bell to open the market at the TSX.

DIVESTED PROPERTIES

PURE FILLMORE APARTMENTS

|